Determining cost basis for rental property

In other words when property is given the recipient receives both the property and the propertys cost basis. The basis of the property is its cost or the amount you paid in cash with a mortgage or in some other manner to acquire the property.

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Rates listed in the Rental Rate Blue Book are intended as a guide to determine the amount an equipment owner should charge in order to recover equipment-related ownership and operating costs.

. Find out how to properly report the sale. If you financed the purchase of the house by obtaining a mortgage include the mortgage proceeds in determining your adjusted cost basis in your home. You may be able to exclude from income all or a portion of the gain on your home sale.

The basis of property used in a rental activity is generally its adjusted basis when you place it in service in. Determine the basis of the property. Here are some of the expenses youll likely see as a rental property owner.

Any gift of depreciated property will trigger the so-called dual basis rules under Section 1015a. 587 Business Use of Your Home for information on determining if your home office qualifies as a principal place of business. The amount paid by the investor for the rental property.

It is a quick and easy way to measure whether a property is worth. Generally property received as a gift are calculated with respect to the original owners cost basis in the property. The management fee is what it will cost to manage the rental if you hired a property manager or someone else to help out at the rental.

150000 purchase price - 15000 lot value 135000 basis for. For more information on basis and adjusted basis refer to Publication 523 Selling Your Home. The amount of money spent on the rental property is considered the total cost of investment.

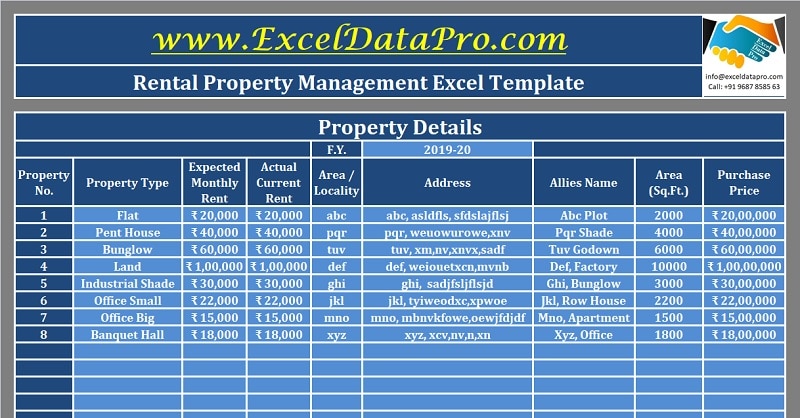

The Rental Rate Blue Book is a comprehensive guide to cost recovery for construction equipment. The deduction to recover the cost of your rental propertydepreciationis taken over a. Total Monthly Operating Costs.

Introduction to Cost Recovery Rental Rate Blue Book. The total monthly operating cost is how much it will take to operate the property on a monthly basis which includes repairs maintenance insurance and more. The sale of a rental property has an impact on your financial and tax obligations.

The gross rent multiplier GRM approach values a rental property based on the amount of rent an investor can collect each year. These rates are derived. Determining the taxable gain or loss from a rental property sale is relatively easy and is done by subtracting the basis from the sale price.

The purchase price can be paid for in cash or be financed through a mortgage lender.

Rental Property Accounting 101 What Landlords Should Know

Tax Benefits Of Accelerated Depreciation On Rental Property

How To Track Your Rental Property Expenses In 2022

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Rules Schedule Recapture

Landlord Template Demo Track Rental Property In Excel Youtube

How To Manage Rental Property Guide For Landlords Smartmove

How To Calculate Cost Basis For Rental Property

The One Percent Rule Quick Math For Positive Cash Flow Rental Properties

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

Download Rental Property Management Excel Template Exceldatapro

How To Create A Rental Property Management Application From Scratch Part 1 Free Download Youtube

Converting A Residence To Rental Property

Property Management Income And Expenses Buildium

Depreciation For Rental Property How To Calculate

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Property Depreciation Rules Schedule Recapture